Definition

“Accounting is the art of recording, classifying, and summarising in a significant manner and in terms of money; transactions and events which are, in part at least, of a financial character, and interpreting the results thereof.”

Q. 1. Why is Accounting an Art? Explain.

Ans. Art is that part of knowledge which enables us to reach our goals and tells us the manner in which

we may attain our objectives in the best possible manner. Book-Keeping and Accounting helps in achieving our desired goal of maintaining proper accounts i.e., to record the business transactions and to know the profitability and the financial positions of the business by maintaining proper accounts. So Book-Keeping and Accounting is an art.

Q. 2. Why is Accounting is a Science? Explain.

Ans. Science may be defined as a systematised body of knowledge based on certain basic principles.

Book-Keeping and Accounting is a science because the business transactions are recorded in the books of accounts on the basis of certain principles,

Q. 3. Why are and Accounting an Art and Science ? Explain.

Ans. Book-Keeping and Accounting are treated as an art because they help in achieving our desired

goal of maintaining proper accounts. They are called as science also because the business transactions are recorded in the books of accounts on the basis of certain principles.

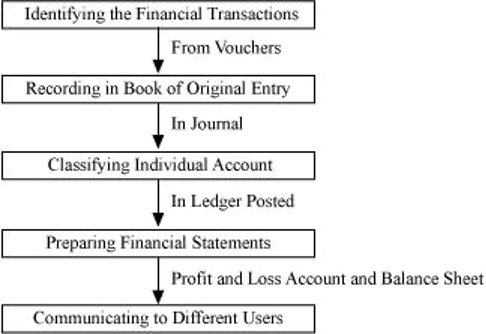

CHARACTERISTICS/ATTRIBUTES/PROCESS OF ACCOUNTING

- Identification of Financial Transactions and Events.

- Measuring the Identified Transactions.

- Recording

- Classifying

- Summarising

- Analysis and Interpretation

- Communication

The fundamental steps in the accounting process are diagrammatically presented below:

Example 1

On 1st Jan., 2022, Mr. Vikas was appointed as Marketing Manager of the firm with a salary of ₹ 250,000 per month. State whether this event will be recorded in the books of accounts.

SOL

No. The appointment will not be recorded because it has not ‘resulted in any change in the financial position of the firm. (It will be recorded only when the salary is paid.) On 1st Jan., 2022, Mr. Vikas was appointed as Marketing Manager of the firm with a salary of ₹ 250,000 per month. State whether this event will be recorded in the books of accounts.

Example 2

A firm has received a large order to supply the goods. Will it be recorded in the books?

SOL

No. Only the receipt of the order has not resulted in any change in the financial position of the firm.

Example 3

Mr. Gopal, the proprietor of a Gopal Enterprises, sold his residential house for ₹ 1 crore. Will it be receded in the books of accounts?

SOL

No, Personal dealings of the proprietor are not recorded in the books of the firm. However, if he invests this amount in the business it will be treated as additional capital introduced by the proprietor and then it will be recorded in the books.

Example 4

Miss Priti, an electronic goods dealer, gifted a washing machine valued ₹25,000 to her friend Suruchi. Will it be recorded in the books of accounts?

Sol

Yes. It will be treated as drawings of Miss Priti and will be recorded in the books.

Example 5

Miss. Meenakshi, the owner of Momo Mami, purchased 5 delivery vans for her business. Without knowing the monetary value of the vans Will it is recorded in the books of accounts?

Sol

No. It will not be recorded in the books.

USERS OF ACCOUNTING INFORMATION

- Internal Users: Owner, Managers and Employees

- External Users: Bank, Government, Investors, Creditors, Researchers, Consumers etc.

BRANCHES/TYPES OF ACCOUNTING

- Financial Accounting: Ascertains the profits and financial position of the business

- Cost Accounting : Ascertains the cost of goods produced or services rendered by a business

- Management Accounting: Supplies relevant information at an appropriate time to the management to enable decision making and exercise effective control.

Sarita Chugh M.Com, B.Edan is Accounts and Economics teacher having more than 30+ years of experience. She is Edupreneur and founded Unique Learning Academy in 2004. She believes that every child has the right to affordable education.